Features of Fund Control

Managing construction loans is time consuming and labor intensive. Now, there is a way to manage this process efficiently, with increased productivity, and reduce inherent risks. Our award winning Fund Control solution:

- Is used by Banks, Mortgage Companies, Private Lenders, and Disbursement Control Companies.

- Is easy to use and set up to your specifications.

- Handles anything from small renovation loans to multi-billion dollar projects.

- Manages changes, documents, inspections, and controls disbursements.

- Mitigates risks during the construction process.

Automated Title Updates

Speed and precision in title management

Our integration with AFX Research automates the title update process, delivering rapid and accurate updates directly within the Fund Control platform. This feature ensures that title updates are processed with an average turnaround time of just 0.74 business days, vastly improving the efficiency of loan disbursements. By eliminating manual data entry and reducing the risk of errors, you can rely on timely and precise information, streamlining your loan management workflow. Enhance your project oversight with seamless and automated title updates, driving faster and more reliable fund control operations.

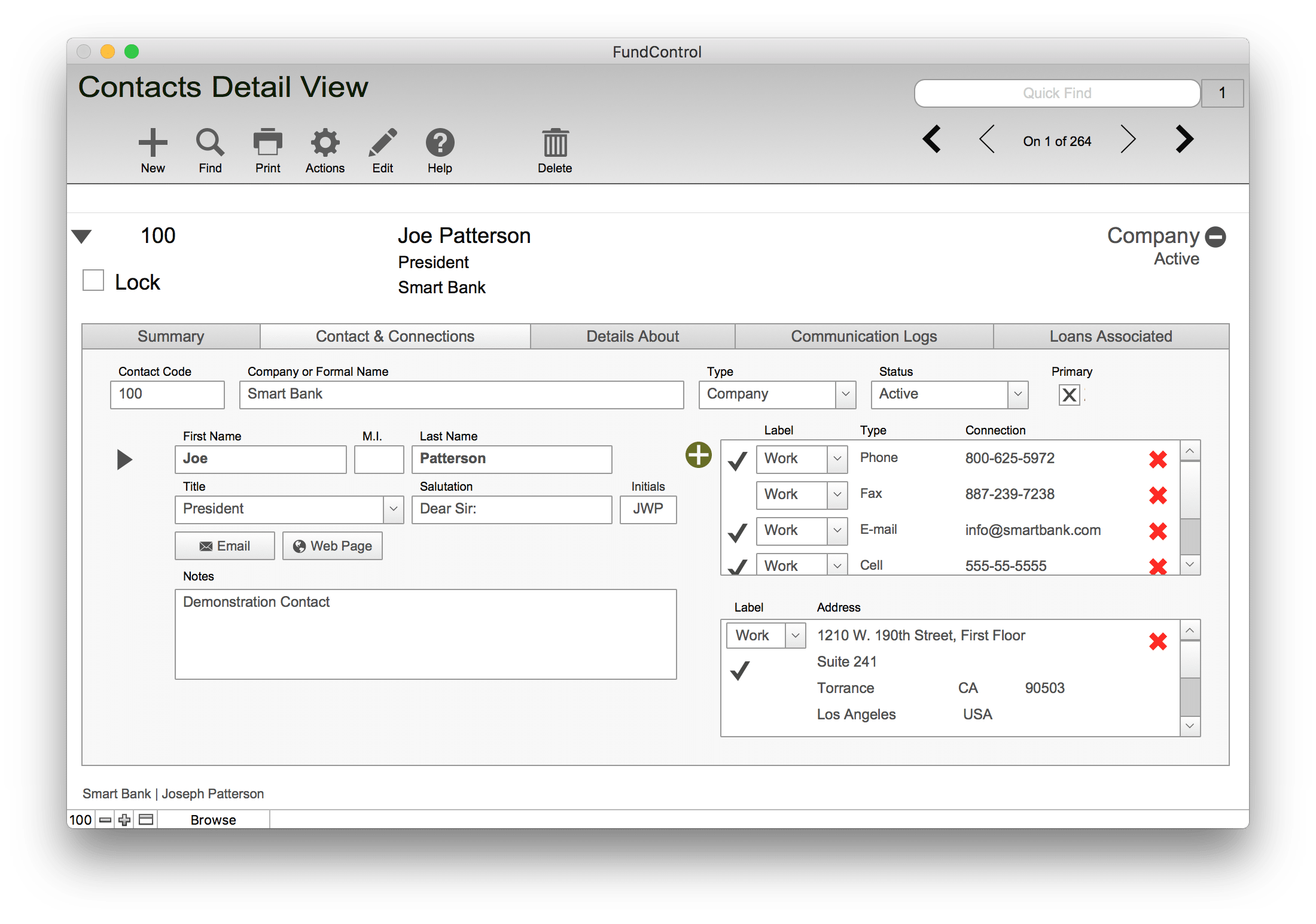

Contacts

Manage all the people you do business with

Keep your leads, borrowers, and contractors organized in one place. Maintain contractor and broker licensing requirements. Manage your borrower relations and so much more.

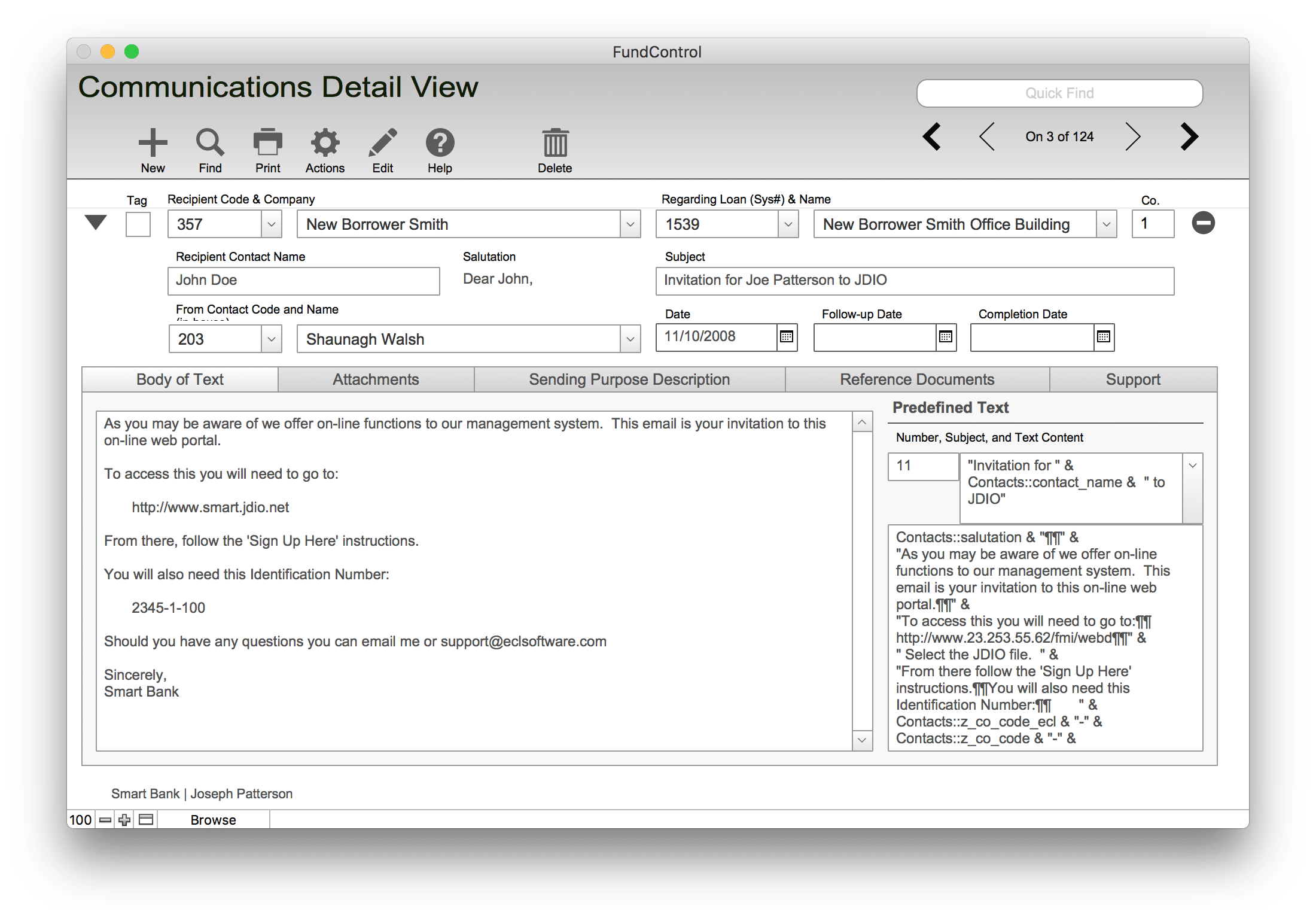

Communications

Create/manage all your notes, letters, & memos

Generation and tracking of all your letters, memos, notes, and letter of transmittals. Utilize predefined text elements and documents to standardize correspondence. All information is fully searchable.

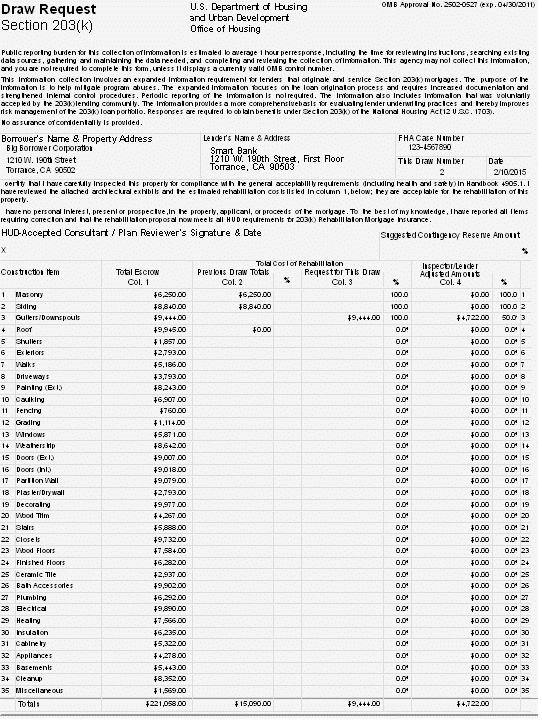

Regulatory Requirements

Ensure loans & borrowers meet regulatory standards

Our customizable fund control software makes it easy to set up and administer specialty loans, documenting compliance with relevant FHA standards each step of the way. It can even be used as an online FHA 203K lending software solution, helping you compile the necessary documents proving that the borrower is on-track with their renovation/mortgage loan.

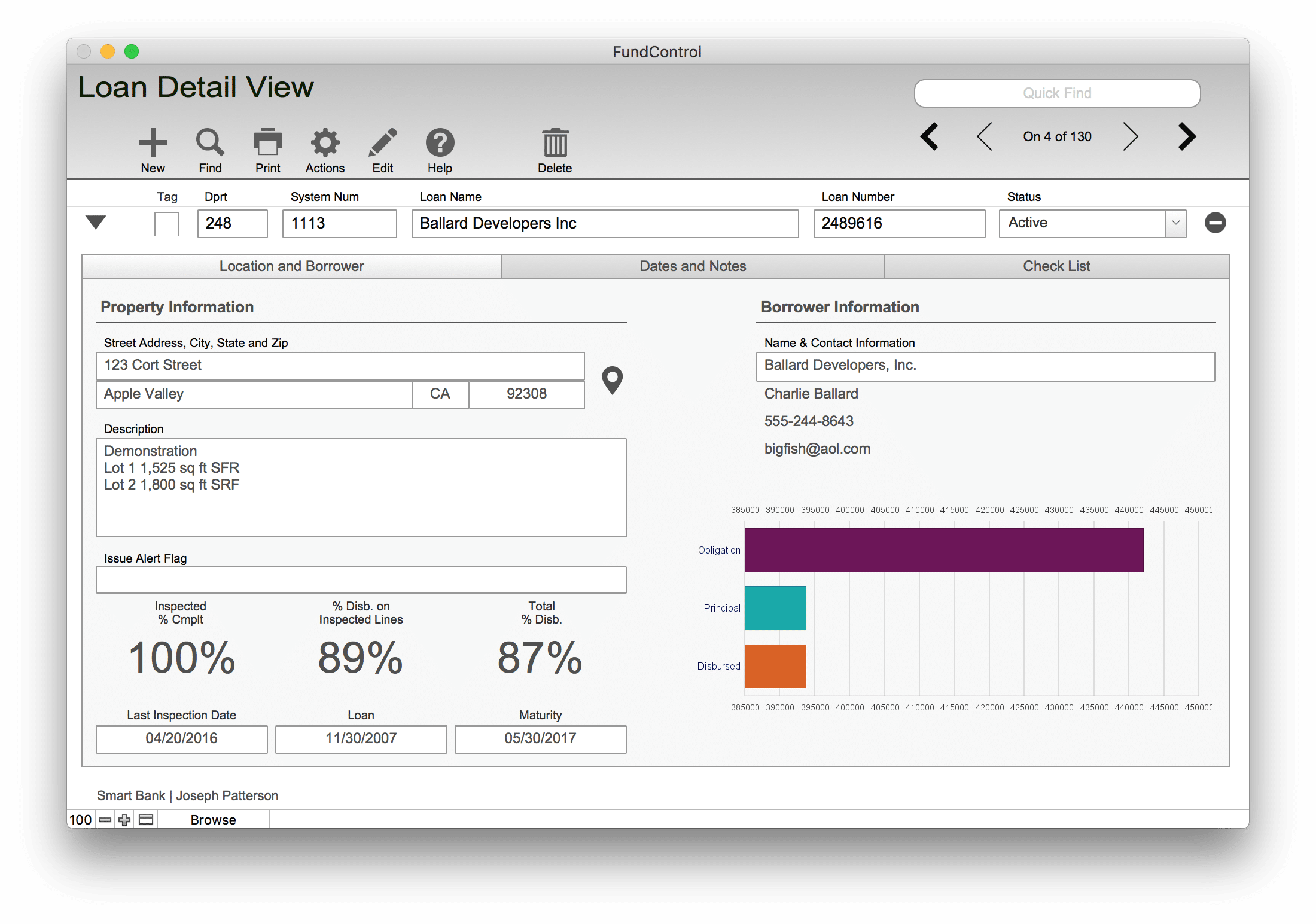

Loans

Comprehensive information about the project

Know all things about a loan, from locations to dates, to the players involved and its financial position. Maintain and create vouchers, legal notices, and notification letters when needed. Track sub-notes and their budgets as well as detailed inspections with pictures.

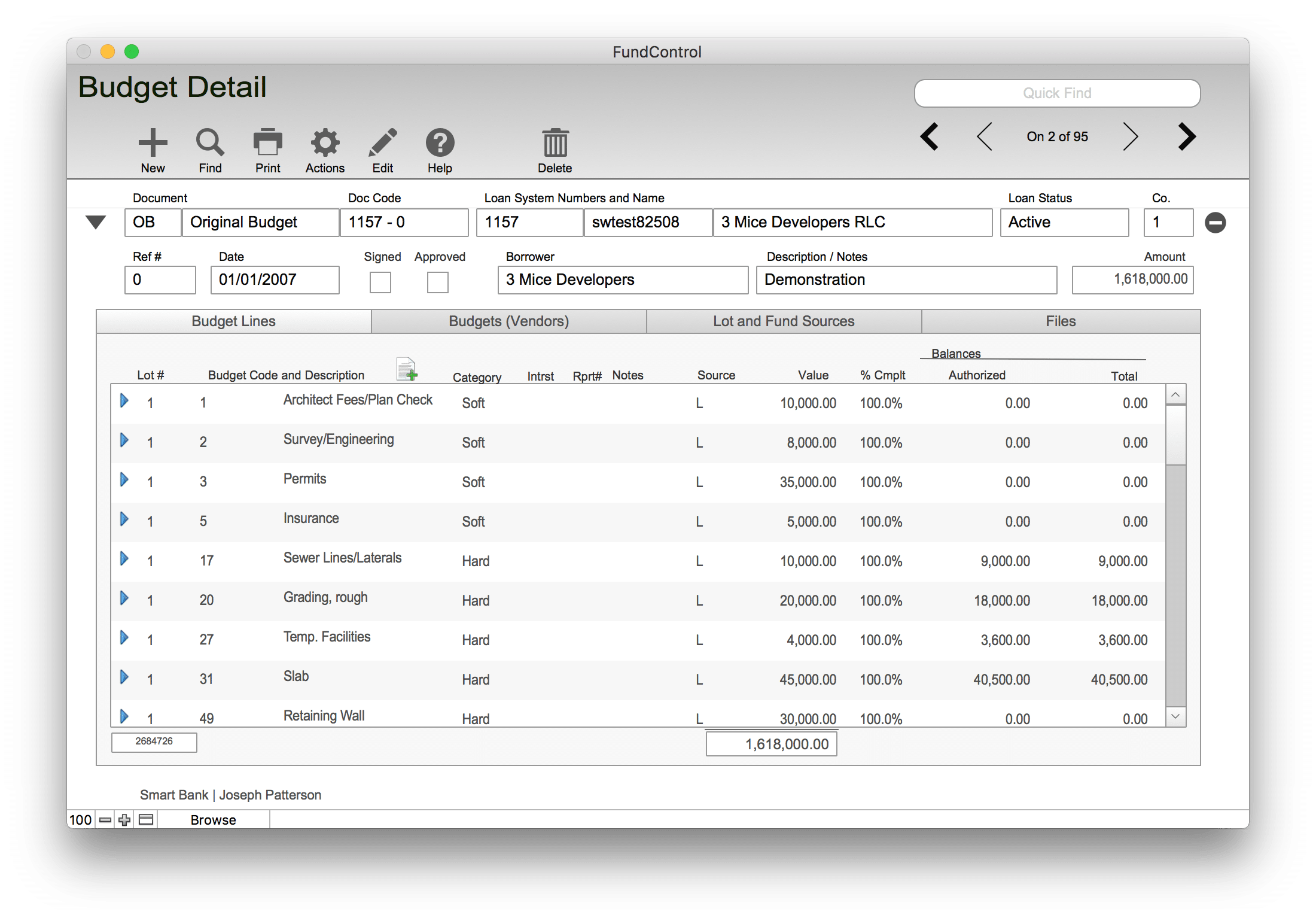

Budgets

How the funds are broken down

Create and Maintain all original budgets and any budget changes. Create budgets from templates, spreadsheets, or by manual entry. Identify special budget line items by categories, interest reserves, and/or special reporting options.

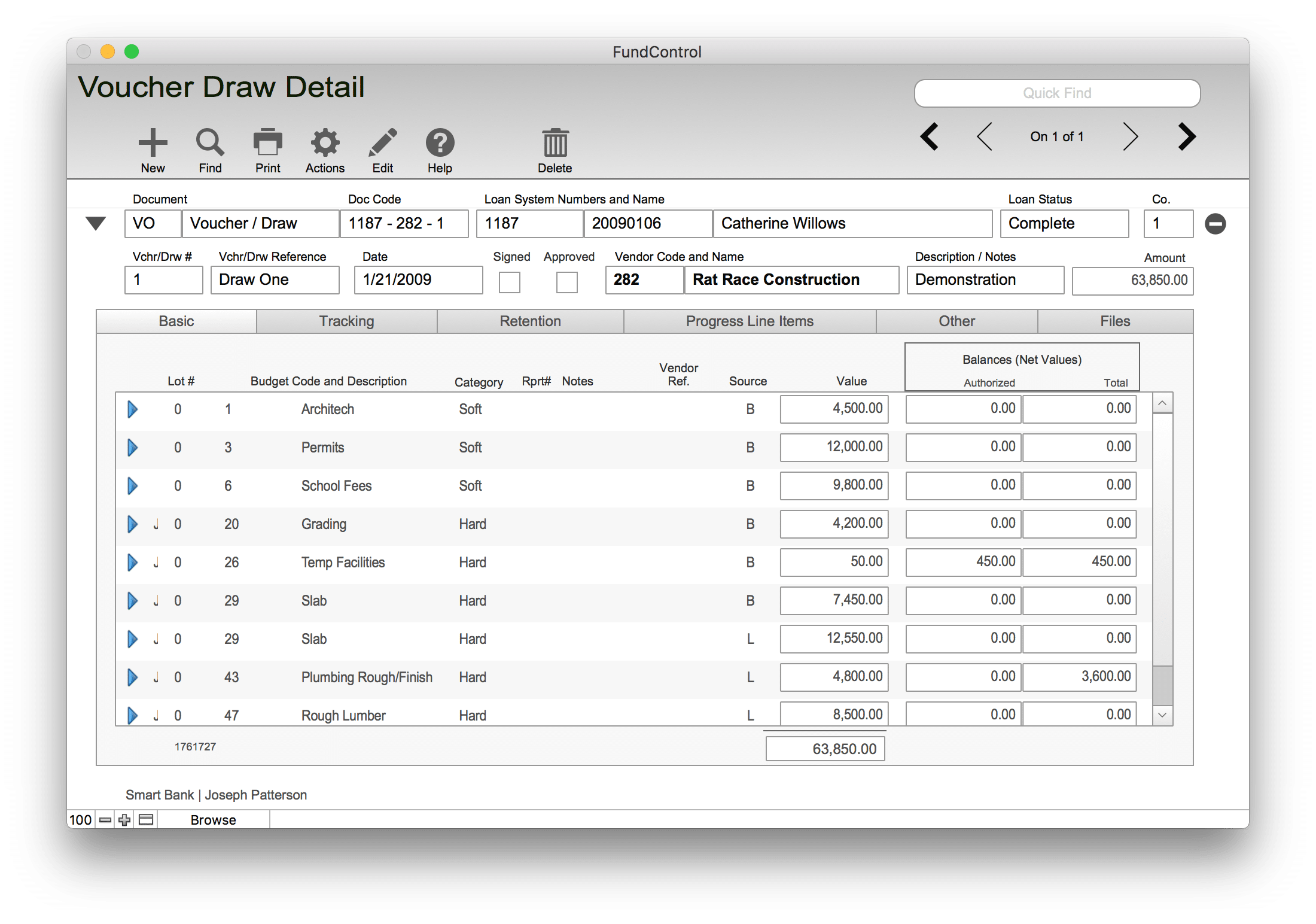

Borrowers

Disbursements to and Pay-downs from

All financial transactions regarding the borrower. Tracking of Voucher and/or draw requests, verifying that all request comply with institution policies; creation of disbursement checks and/or transfer forms; and recording borrower pay-downs in order to manage revolving lines of credit.

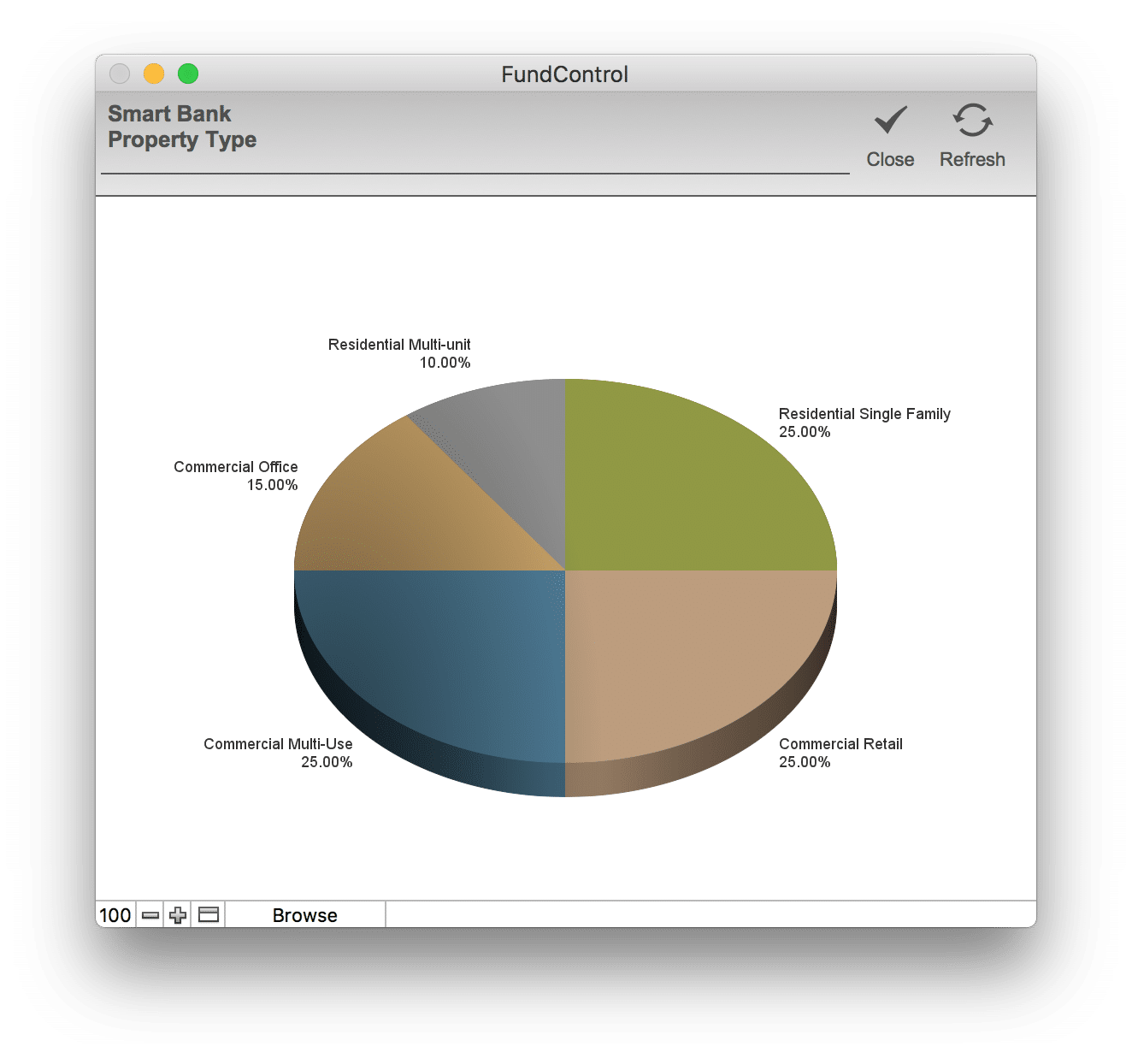

Reporting

Financial detail reporting

Dashboards that show risk assessments, cash flows, and percentage of types of loans. Easy accessible predefined reports for routine processes. Detail searchable reports across loans and vendors. Importing methods of transactions from backend accounting systems.

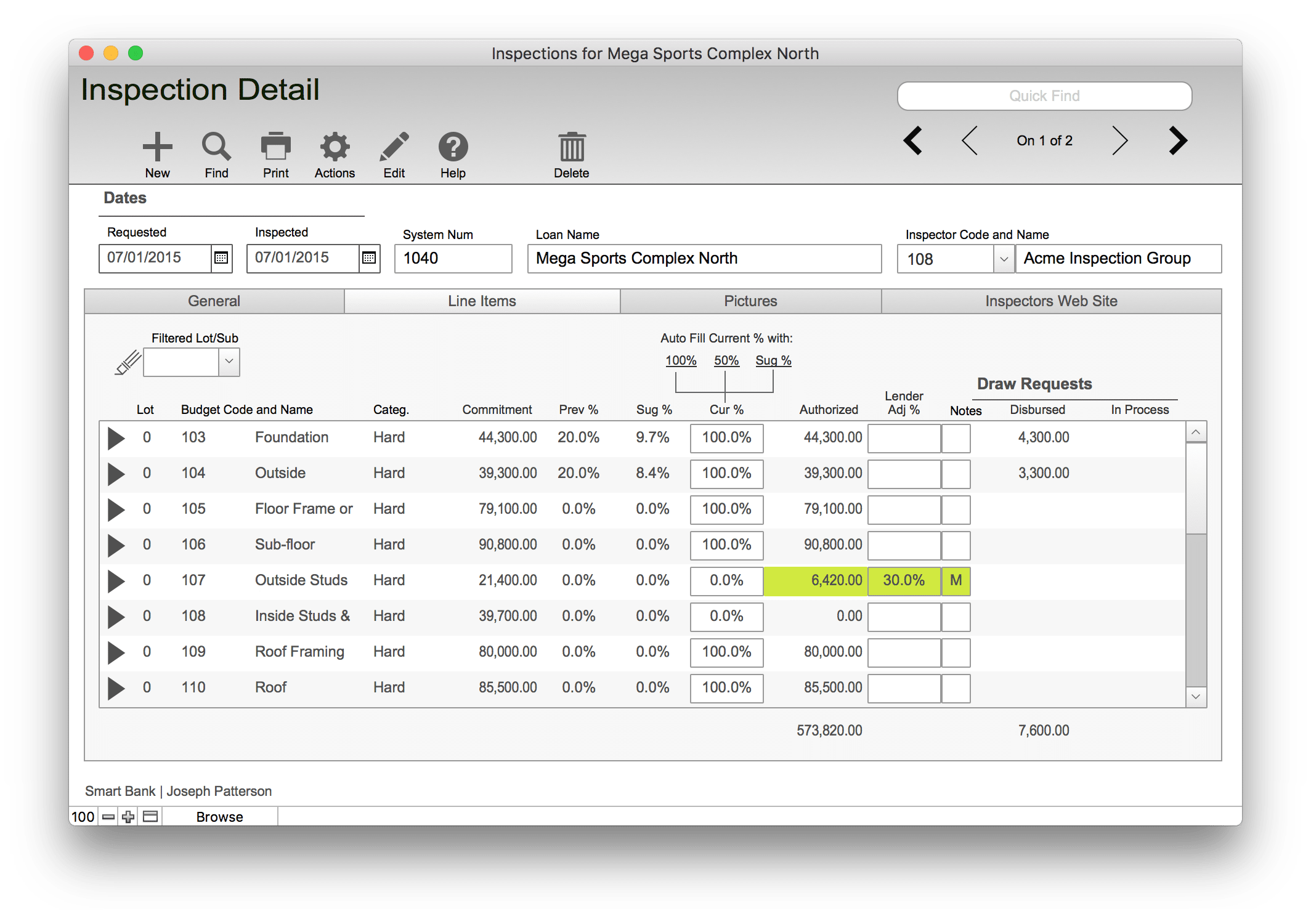

Inspections

Requesting, recording and managing of job site inspections

Provides the tools and functions to request inspections as well as record them, including pictures and other documents. These inspections can drive the approval process or just simply act as a compliance guide. Send PDFs, MS Excel sheets, and even XML files for inspectors to utilize.

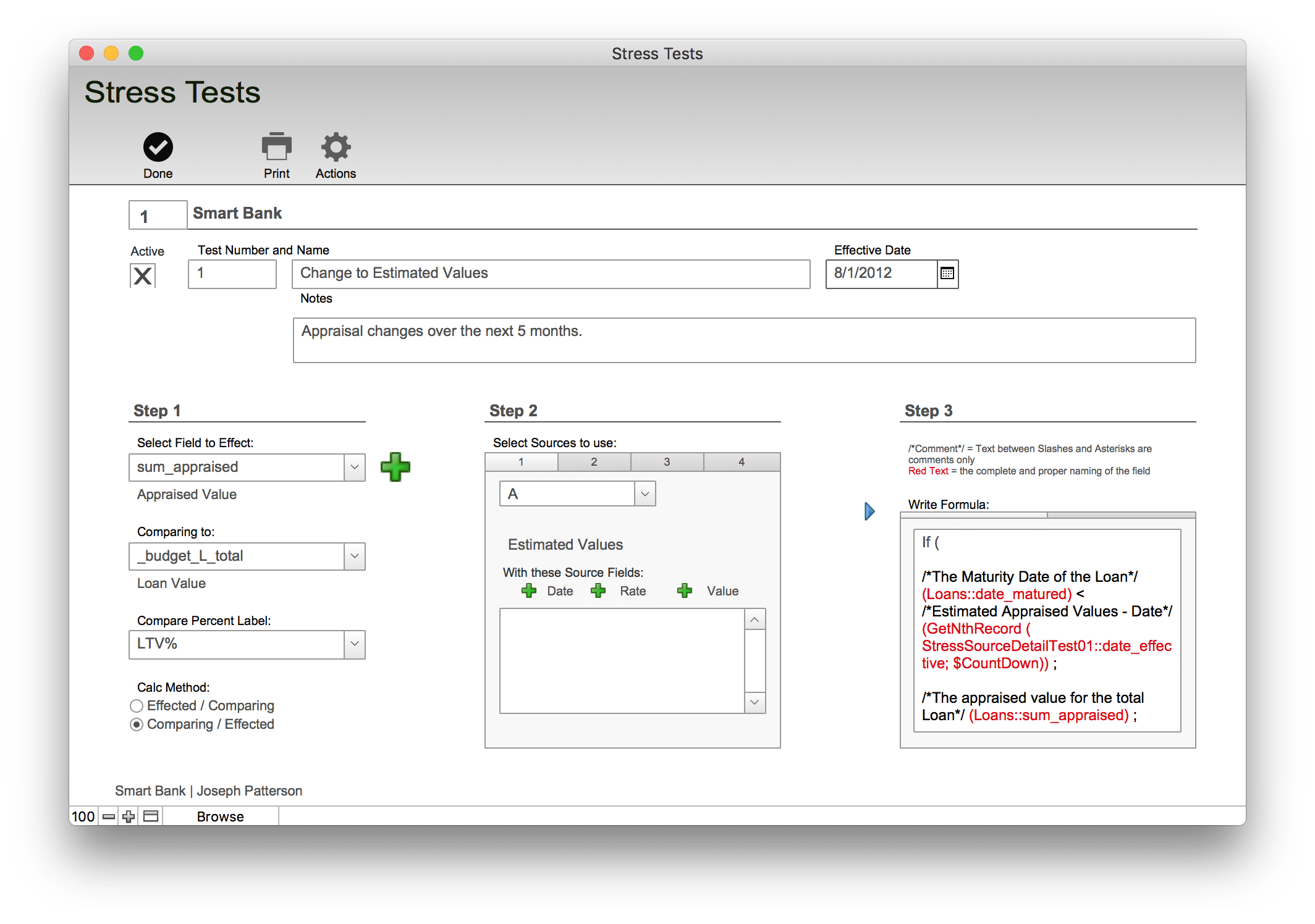

Concentration & Stress Testing

Design of and creation of specialized reporting

Comprehensive concentration reporting. Establish the loans that are to be included in the report. Can be the entire institutions portfolio or just the loans within the system. Create the report based upon company specific criteria as well as multiple sorting options. With the built in Stress Testing, build unlimited portfolio stress scenarios. Create your own sources of stress; configure the formulas that you would like to use; select the loans that are to be stressed; and then run the test and see the effect to your portfolio over time.

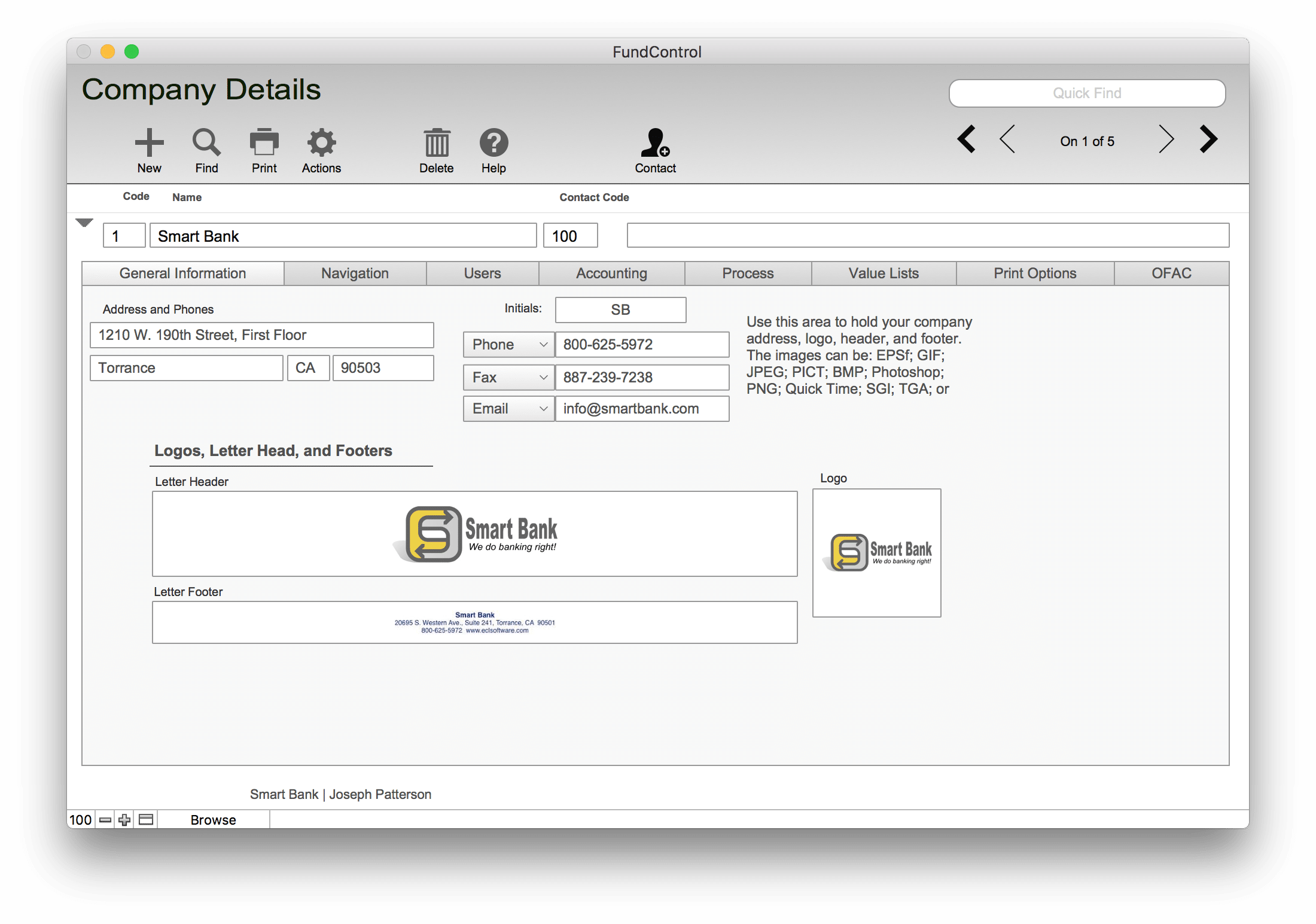

Setups

How you want Fund Control to work for you

Because your institution is unique, there are about 800 settings that you can turn on or off to make Fund Control work the way you do. We have always believed in that you shouldn’t have to learn the software, but the software should learn about you.

Ready To Get Started?

Call us today at 800-625-5972 or sign up here: